By Teresa Adams

Tennessee business owners may soon get an email or letter from the TN Department of Revenue about being eligible to receive economic relief funds under the TN Business Relief Program. This provides relief for tax paid to the TN Department of Revenue and businesses are not required to pay the funds back.

For more information about the program or eligibility, please see the TNDOR website here. Businesses (or their accountants) will need to confirm their eligibility through the TNTAP website here. An example email and instructions on how to apply for the TN Business Relief Program are located below.

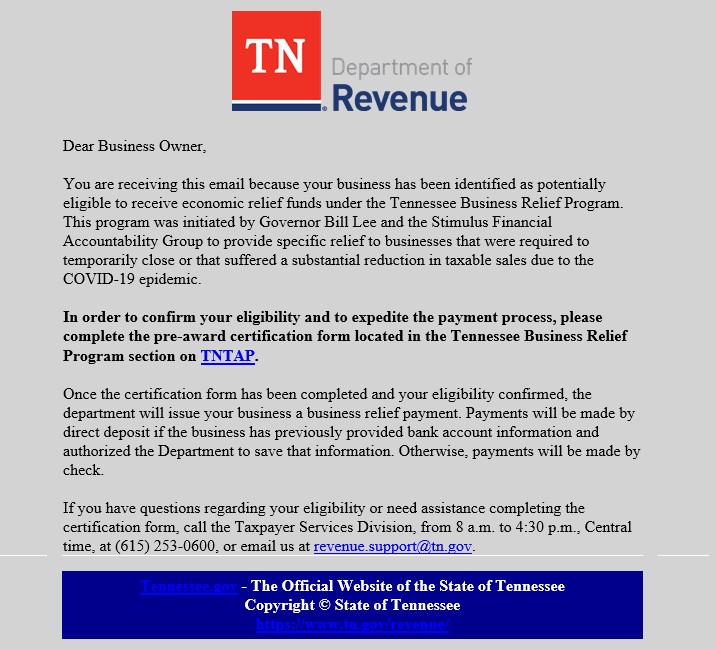

Email received about the TN Business Relief Program

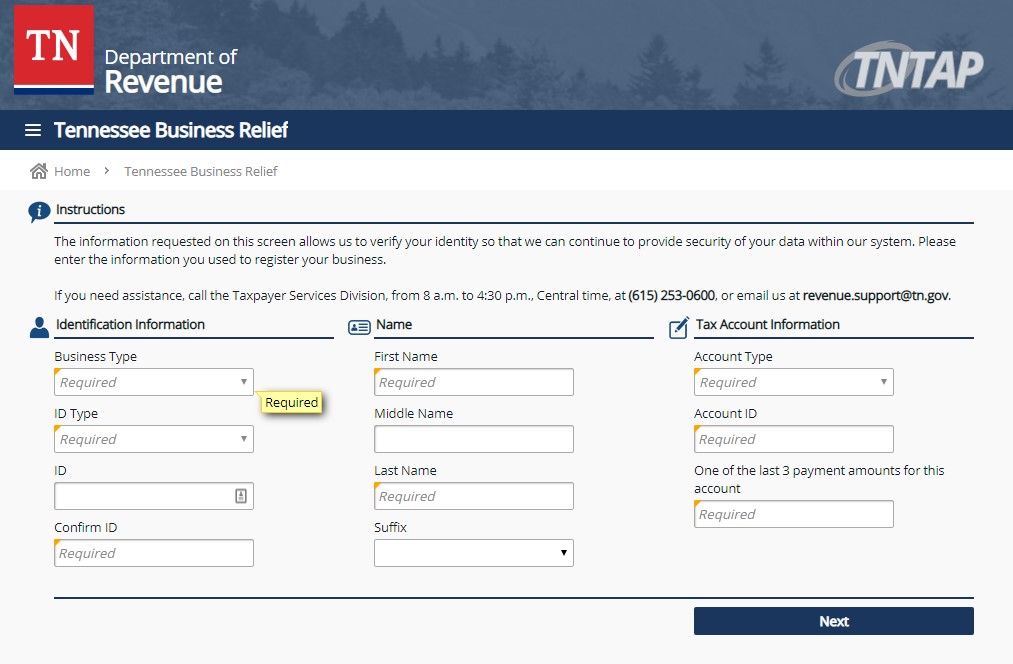

TNTAP INSTRUCTIONS FOR TENNESSEE BUSINESS RELIEF PROGRAM

Go to TNTAP to apply here and click the link under the “Tennessee Business Relief Program.”

In order to confirm eligibility you will need the information originally used to register the business with the Tennessee Department of Revenue.

- Business Entity Type

- ID Type

- Tax ID

- Business or Individual’s name

- Account Type

- Account Number

- One of the last 3 payments made for the account

Click “Next” to continue.

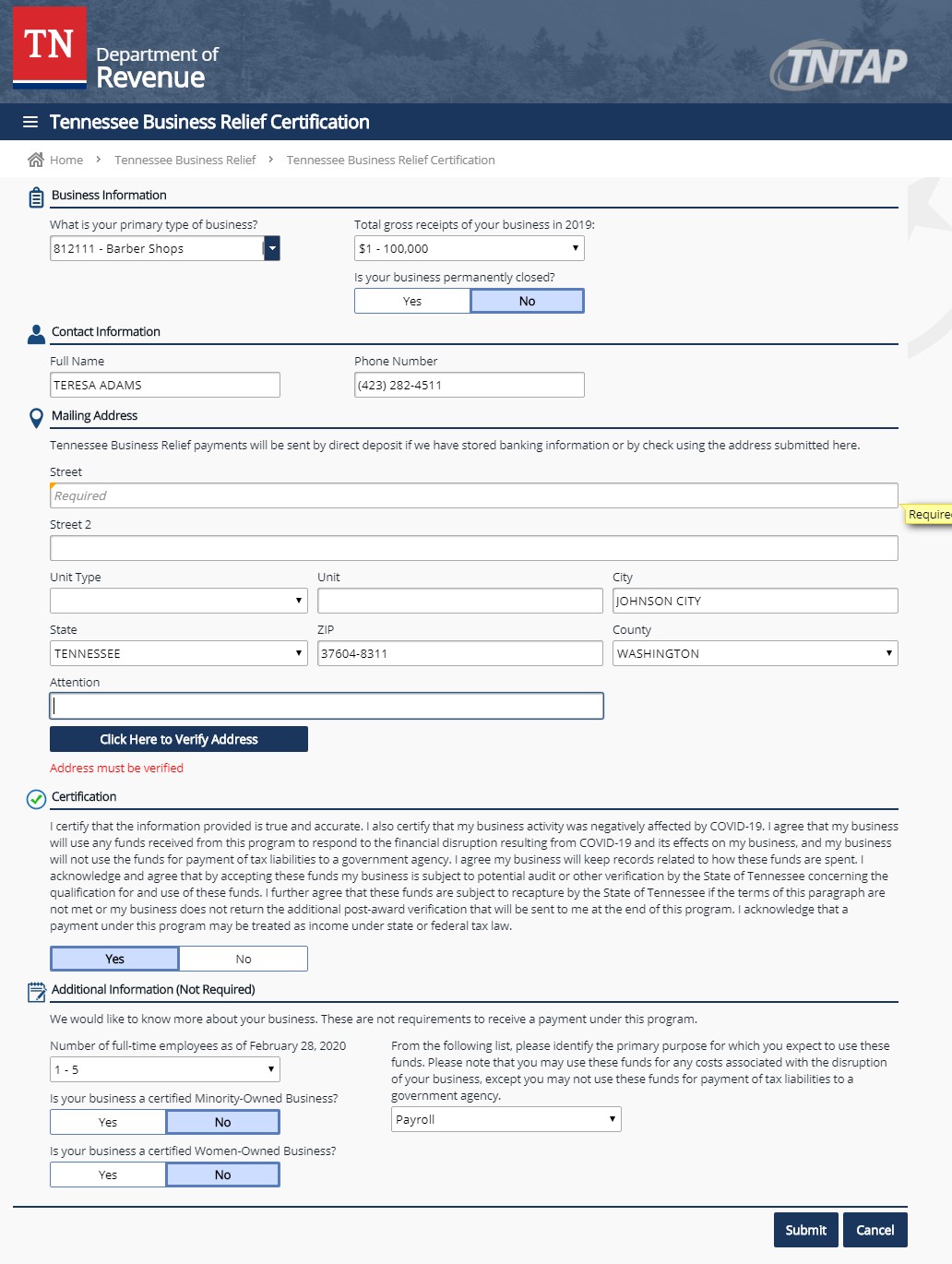

Complete the following questions about the business:

- Primary type of business

- Total gross receipts in 2019

- Contact Information

- Business Mailing Address

- Number of Full-Time Employees as of February 28, 2020

- Primary purpose that you expect to use the funds.

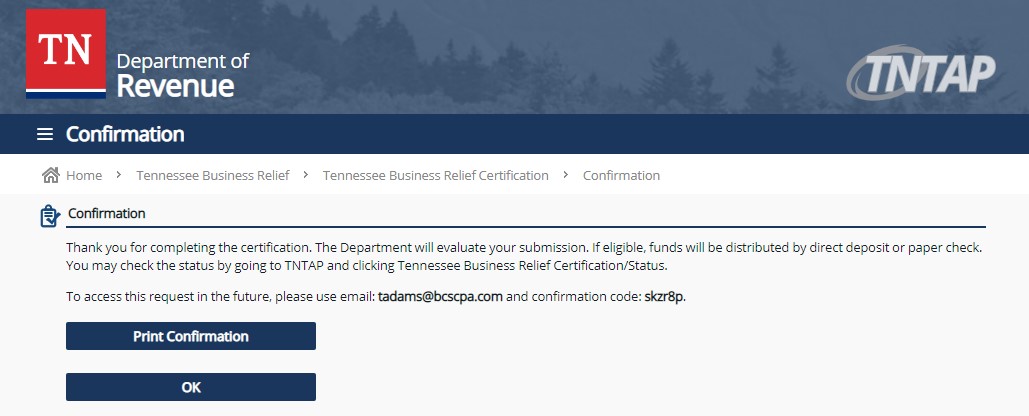

Click “Submit” and enter your email to be able to access the request in the future.

If you or your business has any questions or needs help completing the requirements for Tennessee Business Relief Program, please contact us.